5 Rules You Should Apply ASAP If You Don’t Want To Retire Broke

5 Things You Must Do Now To Save Your Retirement

I had a revelation the other day.

I was researching long-term health care investment opportunities for my True Retirement Wealth subscribers when I realized that most people share one distinct characteristic.

Everyone, no matter their place of birth, education, or skin color, dreams of a safe and comfortable retirement.

However, despite this shared and well-defined vision, few have a plan for how to make sure that dream plays out.

Today, therefore, I offer five simple-to-apply rules for making sure your retirement is everything you’re hoping it will be.

Retirement Rule #1: Save For Retirement While You’re Still Employed

Not saving for retirement while working is the number one mistake that prevents people from living the life they desire.

It’s easy to understand how this happens. The money is coming in every month, and life is still full of possibilities. Who knows… maybe you’ll finally get that promotion… or maybe you’ll start a business of your own and become a successful entrepreneur. When you’re young, it can seem like you have all the time in the world to save for that far-off phase known as retirement.

Then, years go by, and, before you know it, you’ve reached a point where your remaining productive earning years are few and you realize in a panic that you’re soon going to have to live off your savings.

That is why a part of every dollar you earn during your working years should go toward funding your retirement years.

It’s so simple and so hard and, really, comes down to a matter of discipline.

Retirement Rule #2: Avoid Debt

While I’m a firm believer that leverage can have a place in business, I think most people are better off avoiding debt altogether.

If you can’t afford something, don’t buy it.

However, there are times where circumstances might force you to take a loan. In that case, it is vital that you understand the terms of the loan agreement. Dig deep into the small print, make projections, and study possible outcomes. The worst kind of debt is debt you don’t really understand.

Moreover, if you hold debt already, make sure you have a clearly defined plan on how to get rid of it.

There is one more exception to this rule. You can take a mortgage (one, not two) to purchase a home (a place you’re going to live in for an extended time). Paying interest is more sensible than paying rent indefinitely.

Retirement Rule #3: Have A Monthly Budget

Are you living paycheck to paycheck? Then you need to start budgeting your monthly expenses. It’s the only way to begin to understand and to take control of where your money is going.

I think the rule of thirds works best. Spend one-third of your income on necessary expenses such as housing, utilities, health, groceries, and transportation. That leaves one-third for financial priorities like debt obligations and saving for retirement and one-third on leisure activities, entertainment, and travel.

If you can’t make that rule work, prioritize necessary expenses first, financial priorities second, and leisure last.

Moreover, have some money set aside in a reserve fund. Use it only for unexpected large expenses, such as house and car repairs, losing a job, or a health emergency. I suggest you hold six months of living expenses for this purpose. And, most important, be sure always to resupply this fund to its original amount after every withdrawal.

Retirement Rule #4: Consider Insurance

While an emergency fund can cover most unexpected expenses, there is no substitute for an insurance policy.

In the event of your death, you don’t want to leave your children with funeral expenses, mortgage payments, and the like. Instead, buy a suitable life insurance policy to ensure your family is covered.

Also consider disability insurance. Long-term illnesses are unpredictable and can leave you incapacitated in one way or another. With a disability policy, in case of a debilitating emergency, your family can continue to enjoy the same lifestyle even if you’re no longer able to earn a salary.

Shop for an insurance company that sells life and disability policies together, which should be your most cost-effective option.

Retirement Rule #5: Start Investing ASAP

Finally, you should start investing your savings ASAP.

I’m serious. Get started at this today or tomorrow. Don’t wait for another week or another month.

The sooner you start, the higher your retirement amount will become time for retirement. As Albert Einstein pointed out for us, compounding interest is the most powerful force in the universe.

I know you’ve heard these stories before, but I think it’s worth reminding ourselves just how strong this force can be.

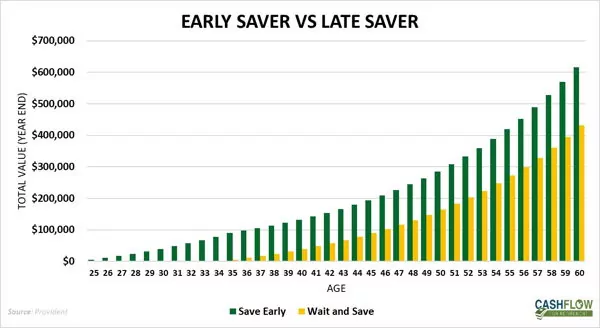

Think about two 25-year-old investors who both decide they want to retire at 60.

Both invest in the same fund, which returns 8% per year, and each reinvests the proceeds.

The “early” saver invests US$5,000 for 10 years from age 25 to 35. By the time she retires, she will have invested US$55,000. Her portfolio will be valued at US$615,000.

On the other hand, the “late” saver invests US$5,000 for 25 years but does it from age 35 to 60 instead. By the time she retires, she will have invested US$130,000. Nearly thrice as much.

You would think that, given this, the “late” saver’s portfolio would be worth a lot more. However, it amounts to only US$430,000.

Good investing,

Leon Wilfan