Buying Real Estate Abroad: The Solution To True Diversification

Main Street And Wall Street Are Out—Here’s What You Should Be Buying Today

U.S. property markets are hot, hot, hot…

Overheated and overvalued.

Likewise, the U.S. stock market.

What’s an investor to do when both Main Street and Wall Street are overpriced?

You know my answer to that question:

Look to property overseas.

It’s the only all-in-one solution to diversifying and profiting across investment markets, geographic regions, economies, and currencies.

Foreign real estate also boasts critical advantages when it comes to taxes, privacy, and cash flow.

It’s the perfect hedge against inflation and stock market corrections.

And right now, thanks to a soaring U.S. dollar, you can find spectacular bargains when you go abroad on everything from beach houses to city condos.

U.S. Property Markets vs. Overseas Property Markets

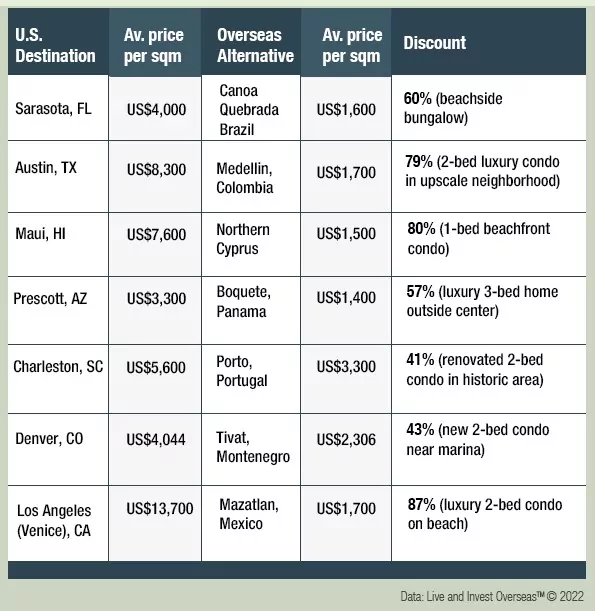

My team and I have just completed a comparison study to show the value you can find right now in key markets compared with popular U.S. markets:

Property in another country is also private (you don’t need to report ownership to the IRS), it’s unseizable (outside the jurisdiction where you live), and it brings diversification (in another market and sometimes another currency).

So why isn’t everyone buying it?

The big challenge with real estate abroad is getting started—knowing the markets, understanding the laws and customs, and sourcing trustworthy contacts.

The good news is that I can help you with all of that.

Understanding And Buying Real Estate Abroad

I’ve gathered my personal network… folks I’ve invested with personally and people I trust…

For a private, online summit this summer boasting discussion, exclusive deals, and intel-sharing.

We’ll analyze listings, negotiate offers, confirm rumors (and quelch others), all while sharing the most up-to-do date information on markets and properties.

Whether you’re just getting started or you’re a veteran player, these are the topics that could supercharge your nest egg or portfolio to the next level.

Specifically, we’ll be talking about:

- How To Use Other People’s Money to build your property portfolio—you don’t need a pile of cash to succeed in real estate investing…

- The best current opportunities: Where To Buy In 2022…

- The Perks And Pitfalls of foreign real estate investing…

- The 4 Secrets To Rental Cash Flow Overseas… plus, how to buy and manage for maximum rental yield…

- Currency Considerations for your international property purchase (at least 4 of my favorite property markets offer “currency discounts” for dollar holders)…

- The fastest ways to escape inflation, recessions, and stock market corrections…

- What you MUST know about using your IRA To Buy Real Estate…

- The Best And Worst Property Investments over the past 25 years…

- All of The Best Property Deals Available Right Now, including beach homes under US$100k and turn-key payouts of US$752,414 and more…

- Analysis Of Every Deal, including market context, historic evaluations, and best- and worst-case scenarios…

That is to say, my 2022 Global Property Virtual Summit will give you the education and the insights you need to diversify your investment portfolio into foreign property…

And then it’ll give you access to the hottest property deals available in the world today.

My team and I are right now finalizing the line-up of offers we’ll feature. These will include opportunities for as little as US$8,800… some with financing… and many with exclusive inventory and pricing for conference attendees only.

The world is a volatile place…

Right now more volatile than in a long time…

And the unfortunate reality is that things could get worse.

Whether you’re looking for an investment to diversify and protect your portfolio… or an escape hatch you can turn to if things go completely sideways… now is the time to act—before it’s too late or too costly to do so.

Stop shopping the conventional retirement markets in the United States. Take your search for the ideal place for your retirement beyond U.S. borders… where some of the world’s most appealing places to be offer absolute bargain opportunities.

Specifically, in the top live-, retire-, and invest-overseas markets on our radar, you can save 50% to 80% (and more) off what you’d pay in comparable U.S. markets.

Join me and my team for my Global Property Virtual Summit taking place June 14–17 for all the details.

Lief Simon