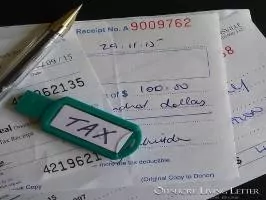

This friend is not American, so he doesn’t have to worry about the Uncle Sam factor. That helps immensely. My friend needs to consider only the tax implications in each potential new country of residence. While taxes shouldn’t lead any conversation about where to move overseas, this is a more important factor if you’re moving […]