The Top Countries With Favorable Exchange Rates

Our Dollar Discount Is At Risk

Recent changes in exchange rates are creating real estate bargains in unexpected markets.

Meantime, some long-time favorable rates—that had been continually improving for almost 10 years—are beginning to turn against us.

Managing the movement of money in foreign currencies is a key factor when investing in real estate overseas. Unless you’re buying in a market that trades in your home currency, exchange rates will affect your purchase price, your rental income, your cost of living while there, how you pay for maintenance and ongoing expenses, and your profits upon exit.

Failing to pay attention to exchange rates in markets where you invest can cost you a bundle.

Take the Mexican peso, for example. In recent years, it’s been trading in a narrow band, generally between 19 and 21 pesos per US$1.

That’s pretty stable. But even within that narrow band, the exchange-rate impact can be significant.

In the case of a luxury beachfront condo valued at 7 million pesos, for example, that small 2-peso spread can cost you more than US$35,000…

Or, conversely, it could save you more than US$35,000.

The Long View And The Recent Turnaround

Looking back over the past several years, buyers with U.S. dollars have accrued a lot of buying power. Properties in some markets are heavily discounted, thanks to favorable exchange rates.

The superstars have been Brazil, Colombia, and peso-priced properties in Mexico (where properties can also trade in dollars).

The most important takeaway here is that, even factoring in the recent changes, these three countries still stand out as bargain markets for dollar holders.

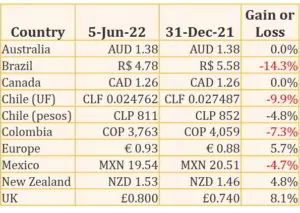

Here’s my personal watchlist:

Dollar-Holders Have Enjoyed A Remarkable Increase In Buying Power Over The Past Seven Years

The result has been dramatic. Today, you could buy:

- A beachfront home in Brazil, with a private yard and pool for US$114k…

- A beachfront condo in Mazatlán, a famous Mexican resort, for less than US$200k…

- A luxury home in Medellín’s premier upscale neighborhood of El Poblado for around US$150k.

If you’ve done any shopping for real estate in the United States lately, you’ll recognize these as world-class bargains.

But things are changing.

Let’s look at what’s happened to exchange rates just since the start of this year. In the chart below, the “Gain or Loss” column refers to the dollar-holder’s buying power…

Why are these currencies reversing direction?

Lief Simon and I have been talking about this currency shift since it began. And, while neither of us claims to be a currency expert or a predictor of the future, two things jumped out:

Brazil, Mexico, and Colombia (whose currencies have gained on the dollar) are energy producers, so they benefit from high oil prices and are unlikely to feel the negative impact of Russia’s oil sanctions.

Chile—while not a major oil producer—is a commodity-rich country that gets almost all its petroleum from its neighbors in South America.

Europe and the U.K. (where the dollar has gained strength) may be affected by the rise in U.S. interest rates, with two rate hikes completed by the Fed and two more on the horizon by July. This may be attracting euros looking to escape Europe’s near-0%interest rates to dollar markets.

If you’re interested in buying in Europe, now is the time to jump into action.

Currently, the Fed expects to raise interest rates two more times, at their June and July meetings. If this is causing a flow from euros to dollars, I’d expect a peak in late July. Some experts are predicting a euro-recovery during the second half of 2022.

If you’re looking in Brazil, Colombia, or Mexico, don’t procrastinate. You still have a very strong advantage, despite what’s happened since the start of the year.

But the trend is running against us in Latin America, and there’s no way to predict when it will change.

Consider These Tips For Near-Term Property Buying In Non-Dollar Markets

Remember these guidelines when preparing for and when managing an investment across currencies:

- Track exchange rates in your markets of interest. This won’t enable you to see into the future, but you’ll begin to know a good rate when you see it.

- Move money when you see a good exchange rate, rather than trying to hit peaks and valleys. Hitting the exact peak is almost impossible.

- Move money in bulk when the rate is good… don’t wait until you need it. If you wait until you need the money abroad, you’re at the mercy of the exchange rate at that time.

- Hedge your funds overseas with high-interest local-currency accounts where available. Since I need money for living expenses in Mexico—and like to take advantage of a good rate—I often end up with more than I need there. With these funds, I buy government Treasury Bills, which earn 8.4% interest at this time. This provides me a hedge against currency downturns.

- Move money abroad to a dollar-denominated account abroad, and then exchange it when the time is right. I used to practice this in Uruguay, where I could hold dollars, euros, and Uruguayan pesos in my account, moving them when the rates were favorable.

- Avoid direct deposits. Don’t automatically deposit your pension, Social Security, or other routine checks in a foreign-currency account. Save those in your home country until the time is right: the fees will be less, and exchange rates can be better. If you need cash in the interim, use an ATM.

- Don’t be greedy. Like many male investors, I’m partly motivated by greed (and the desire to gamble). I recently saw the Mexican peso at 20.7 per USD… a rate I knew was a good one. But I held off, hoping it would go over 21 the following day. Instead, I found myself watching as it sank to 19.7. Luckily, I don’t need the money right away, but I lost an opportunity while trying to hit the peak.

How To Become Currency Independent

For income investors, it’s possible to achieve currency independence abroad. This is when you have a property that’s self-sustaining in a foreign currency, eliminating the need to move money into the country on a regular basis.

In Colombia, my properties were priced in pesos… the rental income was in pesos… and my living expenses, maintenance costs, and taxes were in pesos.

After the initial purchase the exchange rate didn’t matter anymore. The property income paid expenses, and there was no need to move money.

Lief Simon cites his European rental properties as another example of this currency independence.

In the big-picture context of diversifying your portfolio to include properties in other countries and other currencies, this is a worthwhile endgame.

Lee Harrison

Senior Property Editor