Global Property Investing Made Easy—Here’s How

My 4 Favorite Overseas Property Markets

On stage earlier this week for the Global Property Summit, with the help of friends, colleagues, and property experts from around the world, Lief Simon and three dozen experts recounted tales of success… and of failure.

They shared hard-won wisdom with the benefit of hindsight and perspective… with one overriding objective in mind—namely, to answer two critical questions:

How do you make money investing in real estate overseas?

And, as important, how can you lose money investing this way?

The three-dozen global real estate experts who joined us in Panama answered both of these questions from firsthand, real-world experience.

In addition, with their help, we pinpointed markets and current opportunities from turn-key farming buys to pre-construction plays, condo hotels, land, and rentals… short-term, long-term, and commercial…

The timing of this event is not a coincidence. We are right now living through an era in property investing the likes of which hasn’t been seen in decades… an opportunity to take advantage of crisis markets, shifting demographics, technology advancements, mega-infrastructure advancements, and geopolitical realities.

And that’s not to mention perhaps the biggest opportunity of the moment: the strength of the U.S. dollar.

For dollar investors, some of the world’s best property markets are on sale right now.

The challenge today isn’t ferreting out a good property investment opportunity that diversifies you into a foreign market. The challenge today is the abundance of such opportunity. As a friend at the event put it, we global property investors are drinking from a fire hose right now.

How and where to focus?

Yesterday morning, to help frame the discussions and the recommendations to come, Lief and fellow global property investor Lee Harrison presented sample portfolios.

“If you had US$150,000 to invest,” I asked Lief and Lee in turn, “what would you buy?”

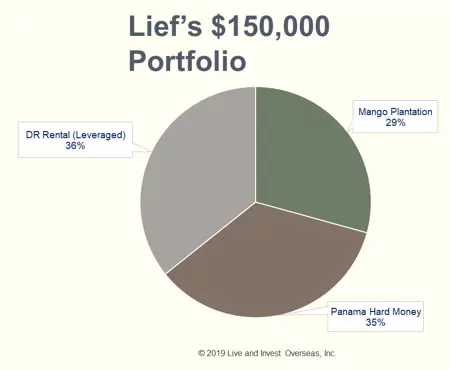

Here’s how Lief responded:

Lief Simon Investment Portfolio

- Resort rental condo in the Dominican Republic (using leverage)

- Mango plantation in Panama

- Hard-money developer loan in Panama (targeting the fast-growing local housing market)

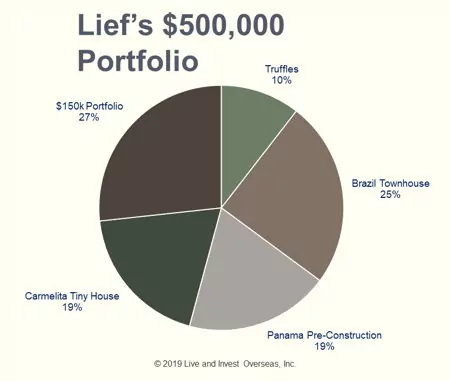

If he had US$500,000 to place right now?

Here’s how Lief would spend that property investing budget:

- Resort rental condo in the Dominican Republic (using leverage)

- Mango plantation in Panama

- Hard-money developer loan in Panama

- Truffle plantation in Spain

- Beach townhouse in Brazil

- Pre-construction condo in Panama (in an exciting new market we introduced for the first time)

- Tiny house rental in a self-sufficient community in Belize

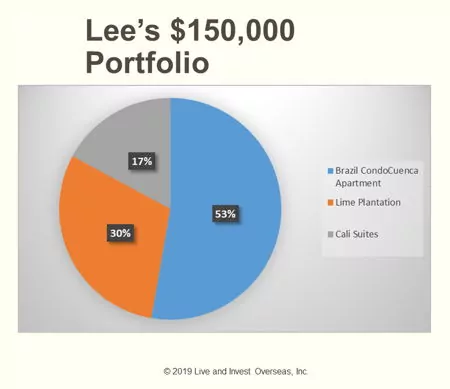

What would Lee buy with US$150,000?

Lee Harrison Investment Portfolio

• Beachfront condo in Brazil

• Lime plantation in Panama

• Short-term rental project in Colombia

Where would Lee place US$500,000 of capital right now?

• Beachfront condo in Brazil

• Pre-construction condo in Dominican Republic

• Managed short-term rental in Colombia

• Lime plantation in Panama

• Truffle plantation in Spain

• Teak in Nicaragua

How do you source timber, agriculture, rentals, commercial space, land, beachfront, pre-construction, and direct property investments in Colombia, Panama, Portugal, Belize, Brazil, Nicaragua, the Dominican Republic, Thailand, Mexico, and beyond?

Our guys have figured that out.

Over the three days together in Panama City this week, our invited property experts from the world’s most appealing property investment markets showcased current investment options across asset classes, across budgets, across markets, economies, currencies, and portfolio agendas.

Every opportunity we’re considering, though, has one important thing in common: It’s turn-key.

This is global property profits made easy.

Kathleen Peddicord