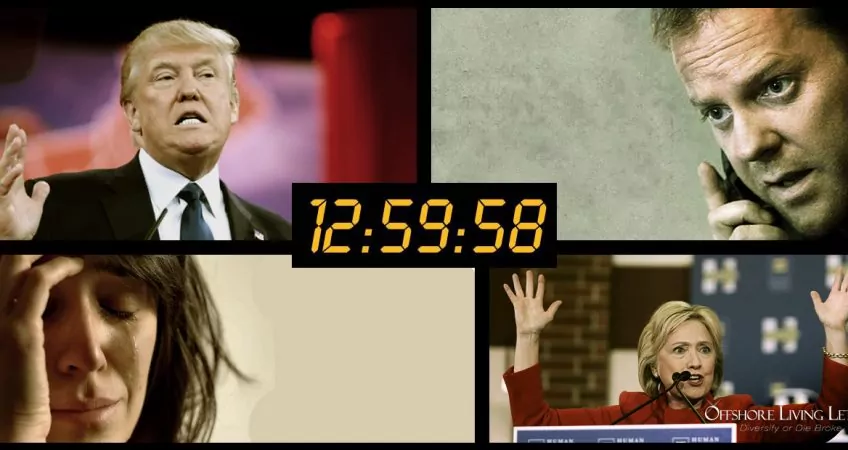

Not Even Jack Bauer Will Save Us From Presidential Elections

Where’s Jack Bauer When You Need Him?

The U.S. election season is winding down… thankfully.

This election has been more embarrassing for this American abroad than any previous such season in my nearly 20 years living overseas.

Watching the debate last night, I kept waiting for Jack Bauer to come running into view on the TV screen and save the day.

The lies and sex scandals we’re used to, but Russians hacking DNC servers and dead people voting in volume? Even the writers of “24” couldn’t make this stuff up.

After all the smoke clears, on Wednesday, Nov. 9, Americans will have a new president.

Regardless of who that is, nothing will have changed.

I’m not the only one who realizes this reality, of course. Polls are showing that big numbers of Americans say they’ll leave the country if their candidate isn’t elected… and some say they’re preparing to leave no matter who wins.

I share the sentiment one of my consulting clients remarked on this week. Like him, I’m not really worried about who wins or the fallout from whatever comes next. My life is internationalized… my flags are planted.

Even now, as crazy as things seem, it’s not all bad everywhere. Opportunities for diversification, of both your life and your money, abound around the world, and it’s never been easier to take advantage of many of them.

If you haven’t yet planted your flags, you have time to remedy that, but maybe not a lot.

Whether you’re looking to improve your lifestyle while spending less money… to diversify your portfolio away from U.S.-centric investments… or to protect what you’ve been able to save in the face of what has become the most litigious society in the history of the world, internationalizing your life just makes sense.

More than that, right now, it’s an imperative.

No, You Don't Have To Go

You don’t have to leave America to do it, and again, you do have time to act before America’s next president, whoever that is, places more regulations and controls on you and your money.

A best first step can be a bank account offshore. FATCA and the U.S. government’s current anti-money-laundering agenda have made it more difficult than it used to be for an American to open a bank account in another country, but it is still possible. At least right now.

Colleagues I trust on the inside of the global banking industry think that it could become much harder very soon for an American to open an offshore account or even simply to move money out of the United States.

It’s impossible to predict whether or when currency or other monetary controls could be put in place in the United States, but I do not rule it out.

Argentines have faced such controls many times in their history… which is why the smart money in Argentina is kept in foreign accounts.

Money on deposit with a U.S. bank earns a negligible return, but a bank CD in a number of other countries can mean a return that is multiples of U.S. rates.

Right now, a three-year CD with a U.S. bank pays maybe up to 1.6%. One bank in Panama is currently paying 3.0% for a one-month CD, and a longer-term deposit in Panama can earn as much as 4.5%. Similar rates are available from banks in the Dominican Republic.

Those are U.S. dollar rates, meaning no exchange rate risk for you.

Step 2 of any Plan B could be backup residency in another country. You just need to choose a country that suits you. In some countries, establishing residency requires an investment—in real estate, a bank deposit, or a business, for example; in others you need only show some guaranteed income (Social Security can qualify).

Establishing a second residency expands your options. Maybe you move to your country of backup residency full time. Maybe you spend part of each year in that place and the rest of each year in the States. Maybe you never spend more than the minimum number of days in the country required to keep your residency status active.

That’s not the point. The point is that you have created a safe haven for yourself… an escape hatch you could slide through if ever you decide you’re ready. Meantime, knowing this out is available and waiting for you can go a long way toward helping you and your better half sleep better at night.

Internationalizing your life isn’t an all-or-nothing decision. And it’s not a one-way trip. You could move to another country for a time and then move to a next country when the urge for moving strikes. Or you could return to the United States if and when the political reality show we’re suffering through right now becomes more real and less show.

It’s all about creating options for yourself.

I’m not exaggerating when I say that this is easier done today than ever.

Lief Simon

Mailbag

“Lief, enjoyed your ‘new Swiss bank account’ piece. I want my money out of reach of all the U.S. agencies that could swoop in on my assets, as you suggest.

“I am thinking of a bank account maybe in Belize or Mexico. I could drive to Mexico. But how safe are their banks? Is this money guaranteed by the government or what?

“Just collecting info to formulate my plan before I venture there.”

R.E.

Few countries have the equivalent of FDIC bank insurance. That kind of insurance just doesn’t exist in the rest of the world.

However, many countries impose bank liquidity ratio requirements. This helps to ensure that banks are liquid enough to handle economic downturns.

Belize, for example, mandates a 24% liquidity ratio. That means 24% of every Belize bank’s deposits must be in liquid assets, either cash or equivalents, at all times.

Liquidity ratios for banks vary day to day, but U.S. bank liquidity ratios have been in the 3% to 5% range for some time.