What Trump’s New Tax Bill Means For Your Offshore Business

Thanks, Trump

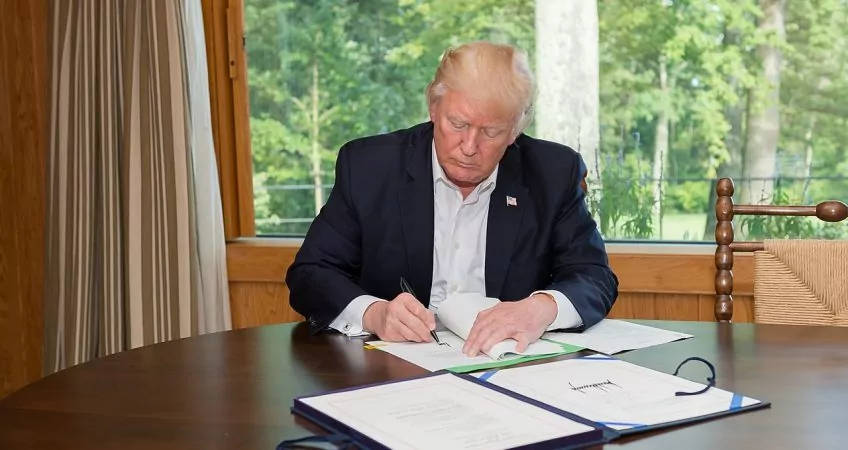

Expats were hoping for better from the tax bill that Trump signed back in November.

Rumors were bandied about that he might, for example, eliminate the worldwide taxation based on citizenship that we Americans abroad are saddled with.

In fact, had he done that (he did not), it would not have made much difference (if any) for most expats living in countries where they are taxed as residents. They (we) would have continued paying as much as we would have paid otherwise in taxes overall.

The benefit would not have been a reduction in taxes paid but the elimination of the need for us expats to file a tax return to the IRS.

Alas, Trump did not eliminate the requirement that an American abroad continue to report and to pay taxes on his worldwide income… and he didn’t do anything else either that affected our tax obligations as individual Americans abroad.

The increase in the standard deduction and elimination of the personal exemptions applies across the board. The changes in the tax bands and marginal rates apply to every U.S. person filing a tax return. So, again, no change for us Americans abroad.

What It Means For Americans With A Business Offshore

Different story for the American expat with a business offshore.

What Trump did for those of us in this category was to create a new tax.

In an effort to get the big boys like Apple and Google to bring their offshore profits onshore and spend the money in the United States, the recent tax bill forces all offshore businesses to “repatriate” and pay a one-time tax on offshore profits that qualified for deferred tax treatment.

I’m using quotes when referencing the term repatriate because the cash could actually be sitting in a U.S. bank account already, in the name of a non-U.S. Apple or google subsidiary, for example. It’s all just a paper shuffle.

In addition to that one-time tax hit on all previously deferred offshore profits, going forward all U.S.-controlled foreign corporations will be subject to tax on their profits annually at the new U.S. corporate tax rate of 21%.

For any American who moved offshore and set up a business operating outside the United States, that’s a tax hit they didn’t initially plan for… and it makes “going offshore” with your business less attractive at this point.

The new tax regime applies only to U.S.-controlled foreign corporations, which would include any non-U.S. corporation held more than 50% by U.S. shareholders.

For some Americans, this tax change will be the impetus for deciding to give up U.S. citizenship as a strategy for bringing ownership of their companies below the U.S. shareholder threshold.

That’s the (very unfortunate) upshot of Trump’s new tax bill as it relates to the American offshore.

Lots more to be said… which is why I’ve given over this month’s issue of my Simon Letter advisory service to the topic.

If you’re a Simon Letter subscriber, you should have received this special-focus issue in your inbox. If not, you should get on board now so you can access my full report.

Lief Simon